A car loan makes it possible for everyone to buy a car. However, due to lack of information people tend to be hesitant to reach out to the bank officials, and even when they do it gets a bit difficult to choose the best loan for their requirement. The whole process of going to the bank and going through meetings, negotiations, and finally picking the best loan requires patience and banking acumen to make the right decision.

Making a smart decision for a bank loan is all about knowing the minute features. Do you know what is a good credit score for you to avail best loan features or do you know the best EMI plan you should opt for?

These are some of the questions you are better prepared to answer with information about:

- Credit score: A credit score is a 3-digit numerical value that determines your creditworthiness i.e., if you are eligible to avail a car loan or not. It is evaluated by taking into consideration your credit history such as timely repayment of past EMIs, credit card debt, bank statement, etc.

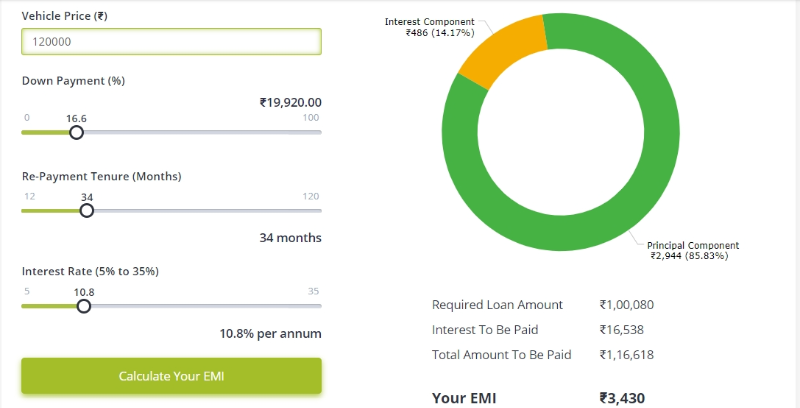

- EMIs: EMIs or Equated Monthly Installments is how you pay for the loan. You have to pay your EMIs on the fixed date of every month for the tenure period.EMIs are calculated by: EMI = A × IR × (1 + IR) B / ((1 + IR) B – 1) where A= Loan amount, IR= interest rate, B=tenure in number of months.

You can also go online to access online EMI calculator and find out the best EMI plan by selecting:

- Price of the vehicle

- Down payment you are willing to pay

- Loan tenure in number of months

- Interest rate at which loan is available

- Interest rates: The interest rate is levied each month on the EMIs you pay. You can either opt for a Fixed interest rate based on the current value or go for a Floating interest rate which is in accordance with the prevalent interest rate in that month. However, with floating interest rates there is a risk of incurring extra charges due to higher interest rates.

- Car loan tax benefit: Car loan tax benefits can be availed on commercial vehicles. To avail the tax benefit, you can show the interest paid in a year as an expense to bring down your taxable income. However, the tax deduction is only available for the interest component of the loan and not for the principal amount.

With the emergence of many ecommerce platforms, all the unnecessary hassles associated with the traditional process of going to the bank are made negligible. You can enjoy a seamless process without having to visit the bank.

Now, Know the process of applying for a car loan online

You can get the car finance online by going through the easy-to-follow 4 steps mentioned below:

- Apply for a loan

Ecommerce platforms such as Droom offers Credit to the interested buyers for their convenience. To begin the loan application, you have to provide basic details into your PAN card details, Aadhar card, residence address, employment history, etc. Based on the information provided, a credit report is generated to check your creditworthiness. - Check your creditworthiness

Your creditworthiness is determined based on your credit score that ranges between 300-900. Your credit score must fall between 750-900 for best interest rates and leading lenders. If you happen to have a lower credit score, you can work to get it in the higher range by making smart financial decisions for 6-12 months before you go out to apply for a car loan. So, it is always suggested if your score is low firstly improve your credit score than apply for a loan. - Submit documents

Once you got approval for the loan, you have to submit Aadhar Card, salary slips for the last 6 months, current address proof, PAN Card, and Bank statement online to complete the documentation for your loan application. It is a paperless process wherein you can submit details from anywhere. - Choose from the top banks and NBFC

Post the completion of the documentation process, the lenders contact you to discuss the loan term & conditions. Do not be hasty in your approach and discuss the loan term with multiple lenders to negotiate for the best loan features.Applying for a car loan online is relatively easier now. There are no bank officials pestering you or throwing banking jargons to hasten the process. Even if you are applying for a car loan for the first time, you can easily proceed with your loan application without thinking much.

Just make sure you have all the above-mentioned eligibility and documents with you and you will soon get the approval for sure. You can make your own decision and even involve your friend or family members for timely advice.