A credit score is the single most important term which is evaluated by the bank officials to determine your loan eligibility and loan features. You can check the credit score report online. It is a 3-digit value in the range of 300-900, which takes into consideration all your financial history.

The higher the credit score, the better are the loan terms.

What factors influence your credit score?

Many factors impact your credit score. These include:

- Credit Card history

- Repayment of EMI’s

- Amount of credit inquiries

- Payment history

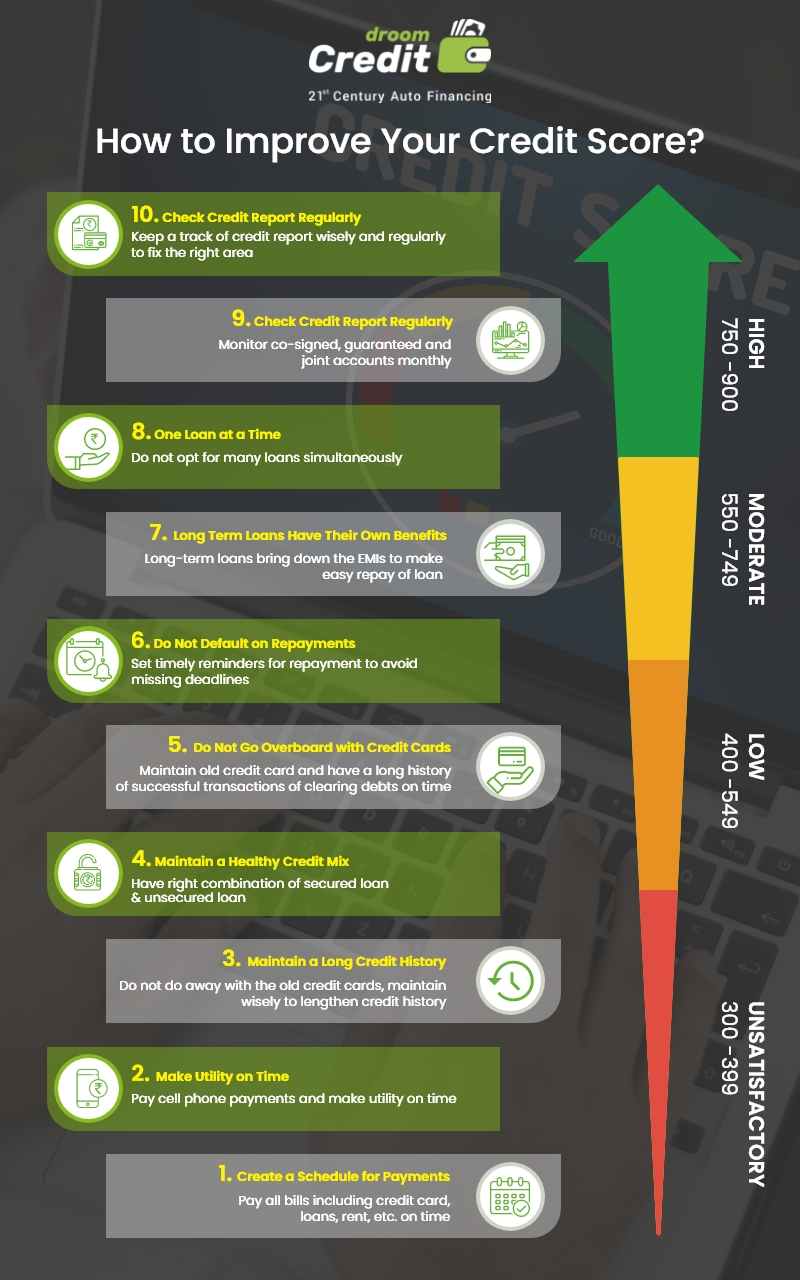

Based on assessing the above-mentioned information your credit score is generated as:

Unsatisfactory (300-400)

Unfortunately, the credit score between 300-400 is not deemed to be creditworthiness. You can work on to better your credit score

Low (400-500)

A low credit score means that you are eligible for a loan however, the loan terms & conditions and interest rates might not be the best ones according to your expectations.

Moderate (500-750)

The moderate credit score means that all the leading banks and NBFCs will be offering you loans with exciting features, but the rate of interest can be high.

High (750-900)

If you fall into the high bracket you get to avail top loan terms and conditions that too without any hassle. You are the one leading the negotiations and get the liberty to choose the best interest rates from top banks and NBFCs.

You can check credit score free by going online. Droom’s credit score checker helps you find out your credit score within seconds. By providing the basic information, you will know if you need to work on to improve your credit score or not.

How fast can you raise your credit/cibil score?

It generally takes about 12-18 months to achieve the perfect credit score of above 750. You can achieve the same by making smart financial decisions and efficient planning to clear your existing loans or credit card payments.

Firstly, check the credit card report online to find out credit history. This will help you identify the precise reasons why your credit score is low than expected. Working on those factors specifically can help you to increase your credit score from 300 to 900. It will be easy to improve your score from 300 to 500. But, if you want to know how long does it take to build credit from 500 to 700, then it will take time which can vary between 6 months to 1.5 years, depending upon how wisely you are working on it.

Follow these four ways to improve your cibil score fast

You need to undertake 4 measures to improve your bad credit score fast and you will have top banks & NBFCs lining up at your door with top loan features:

- Do not go overboard with credit cards: It is better to maintain an old credit card than to opt for a new one. A long history of successful transactions of clearing debts on time has a positive impact on your credit score.

- Do not default on repayments: It is better to set timely reminders for repayment than to miss out on deadlines. Every time you miss out on repaying your EMI’s your credit score takes a hit. While going for loans, it is better to discuss the repayment plans and see if there is a grace period that you can be allotted within the loan terms & conditions.

- Long term loans have their own benefit: You can bargain for lower interest rates on long-term loans and bring down the EMI’s. Long terms loans make it easy for you to repay the loan and ensure that your credit score is maintained.

- One loan at a time: Do not opt for many loans simultaneously as the number of loans on your name impact your credit score and failure to pay off for any brings down your credit score. Also, multiple loans only tend to add up to the stress of repayment.

All in all, it is about maintaining financial acumen and bringing discipline into your spending. No rash financial decisions and no unnecessary overspending. Once you ensure these, the rest follows by itself. If you are looking to apply for a loan in near future, it is better to get started now with a free credit score check to find your credit score to ensure that you can maintain a high credit score for the best loan terms & conditions.