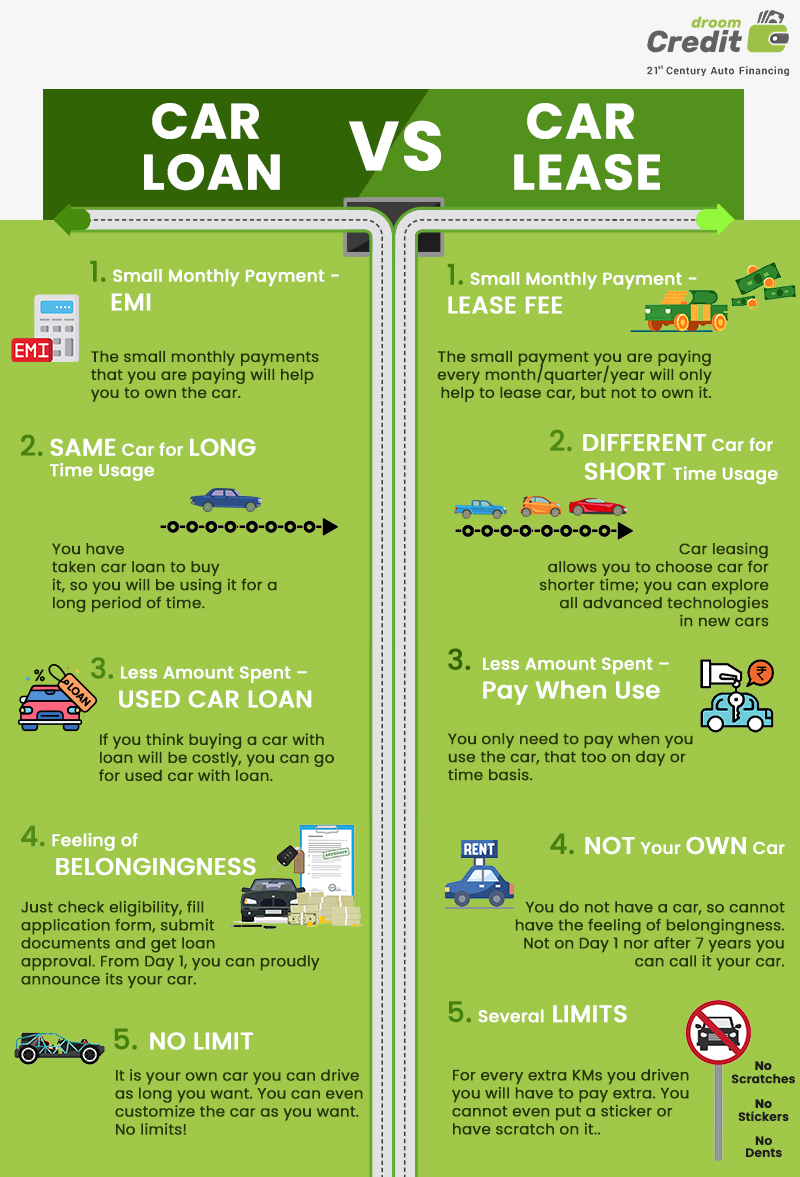

Leasing a car is an alternative to buying a car. People take short term or long term lease of cars due to various reasons like sudden requirements of frequent movement, short-term trips, and transfer to a new city for a certain period. Leasing a car solves your transportation problem for the time being but for many people, it’s not a good solution, they look for a car loan to buy a new or used car. Owning a car provides them complete freedom and peace of mind. If you are in any confusion about which one is better between car loan vs car lease then, think twice and explore the options available to you.

What is a car lease?

If you are considering leasing a car, you should know all its advantages and disadvantages as well. A lease is a contract in which two parties are involved – a leaser and a lessee. Leaser is the owner of the property. In this case, the leaser is the owner of the car you are offered in lease. On the other hand, if you are borrowing the car, you are the lessee. The process of leasing a car always follows some rules and regulations. An agreement is made between the two parties before leasing the property.

The difference between car leasing and financing is that with financing or car loan you proceed to buy a car and consequently own the car whereas, in the case of leasing, you don’t own the car. In absence of any term that says that you own the car at the end of leasing period, you have to return the car at the end of the term period.

What is a car loan?

Owning a car is no more a luxury in city life today. A car is one of the biggest purchases and assets for the owner. These days, most of the buyers in this market opt for car loans. As online car loan approval has become easy and fast, buyers feel comfortable in applying for the loan. Car loans come with different terms and conditions depending on the bank or financial institute from which you are availing the loan. Here are a few important aspects of a car loan –

- A car loan is the total sum of money an individual or organization borrows from a bank or any other type of financial institution.

- As a buyer, you can avail of a car loan for buying either a second-hand car or a new car.

- Terms and conditions change with banks or financial institutions – choose the option, especially EMI tenure as per your convenience.

- Banks or financial institutions provide as much as 100% car loans- here again, choose as per your convenience.

It’s always feasible to take expert advice like Droom Credit while applying for a car loan. You must compare two more credit options before taking any final decision.

This is the difference between a car loan vs car lease. It’s always better to make a wiser financial decision. And, a few of the benefits clearly show that borrowing a car loan is much wiser than taking a car on lease. By doing this, you can buy your own dream car and can pay the amount with ease. Now, after knowing about a lot of benefits of car loan over car lease let’s move forward towards the steps on how you can apply for a car loan.

Follow These Steps to Apply for Car Loan:

As you decide, apply for the car loan in some easy steps. With the advent of an online car loan approval system, your job is now far easier than ever–

Step 1 – Fill up the application form that needs all your basic information like name, address, age, income, profession, etc. Ask the expert online if you need any further information in this regard.

Step 2 – Your application is processed immediately and your credit report is examined. All take place within a few hours. After processing your information and checking your credit score, an online platform like Droom that is a single-window solution for all your basic necessities in this domain lets you know what types of loans are available for you.

Step 3 – As you get all the options, scroll down, and select the one you think the most suitable. Go through all terms and conditions including the EMIs you have to pay every month, what happens if you fail to pay an EMI, what happens if you miss the deadline, etc.

Application for car loan and loan approval process is much advanced now. Support of Droom Credit helps thousands of car buyers every year obtaining the right car loans as per their convenience. These jobs are paperless and real-time. In most cases, a car loan is approved on the same day.

Having a car means complete freedom from the daily hassle of commuting to your office, market, or elsewhere. Life becomes easy. You save lots of time that you can invest in other innovative works.